| For Buyers:

Welcome to a balanced market*, how quickly the tables have turned! While seller markets are ideal for the not-so-perfect home, balanced markets are ideal for the not-so-perfect buyer. This means that buyers who have been recently rejected due to lower down payments, non-conventional financing, or need for closing cost assistance will find sellers are now willing to work with them in this new environment. Supply across all price points is up, with 53% of active listings added by new home developers and investors. Builders especially are dropping prices and offering unique buyer incentives to compete. Experts don’t know how long this period will last as it depends on what interest rates do over the next few months, but home buying just became fun again.

For Sellers:

The proverbial “Dump Your Junk” season is over, that loving phrase the industry uses when demand is significantly higher than supply and even the smelliest dilapidated property gets multiple offers over asking price. That is no longer the case as of this writing. Get ready for longer marketing times, multiple price reductions, Realtor® tours, price opinions, staging, repairs, seller-paid closing costs and price negotiations. The extreme seller market is over.

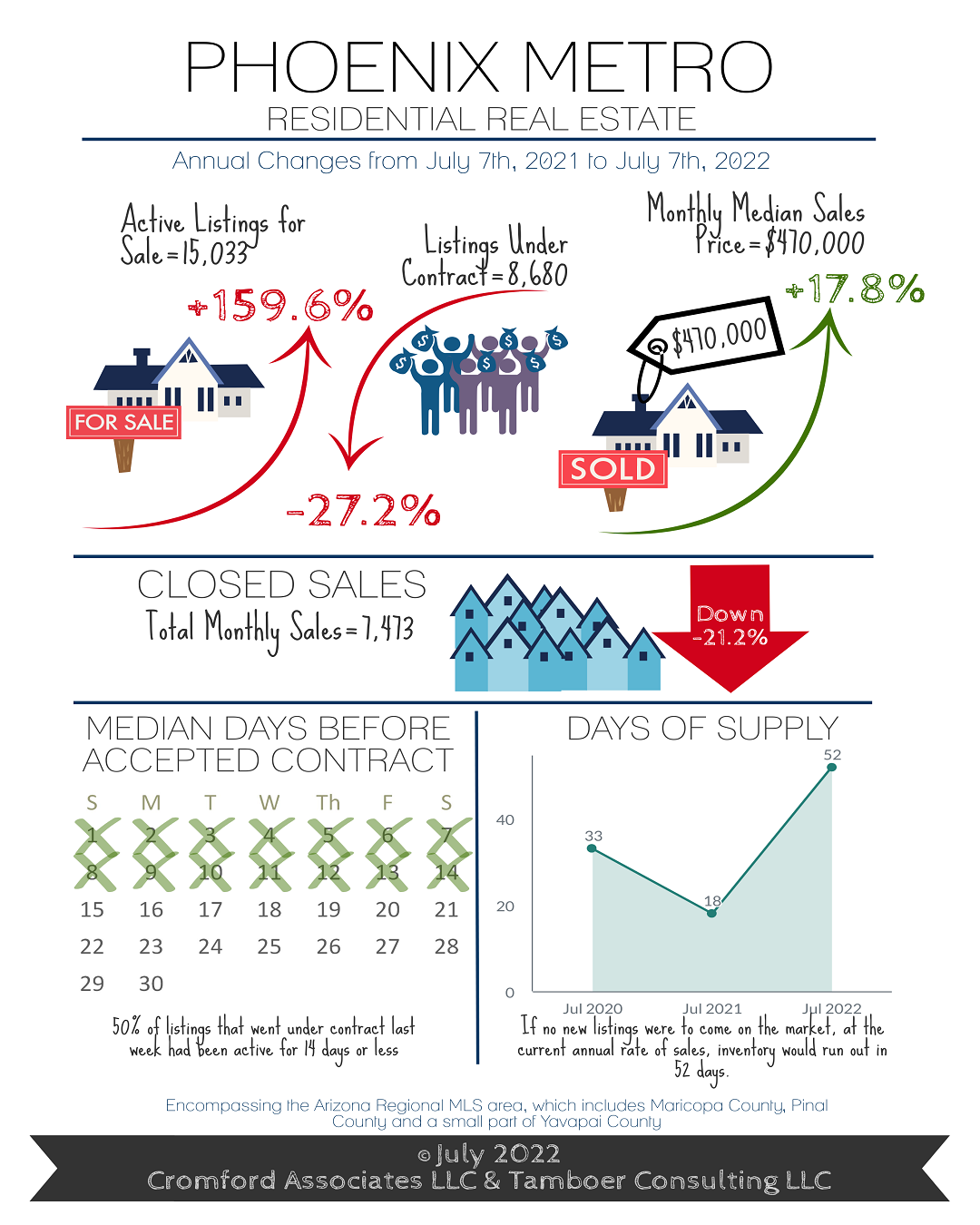

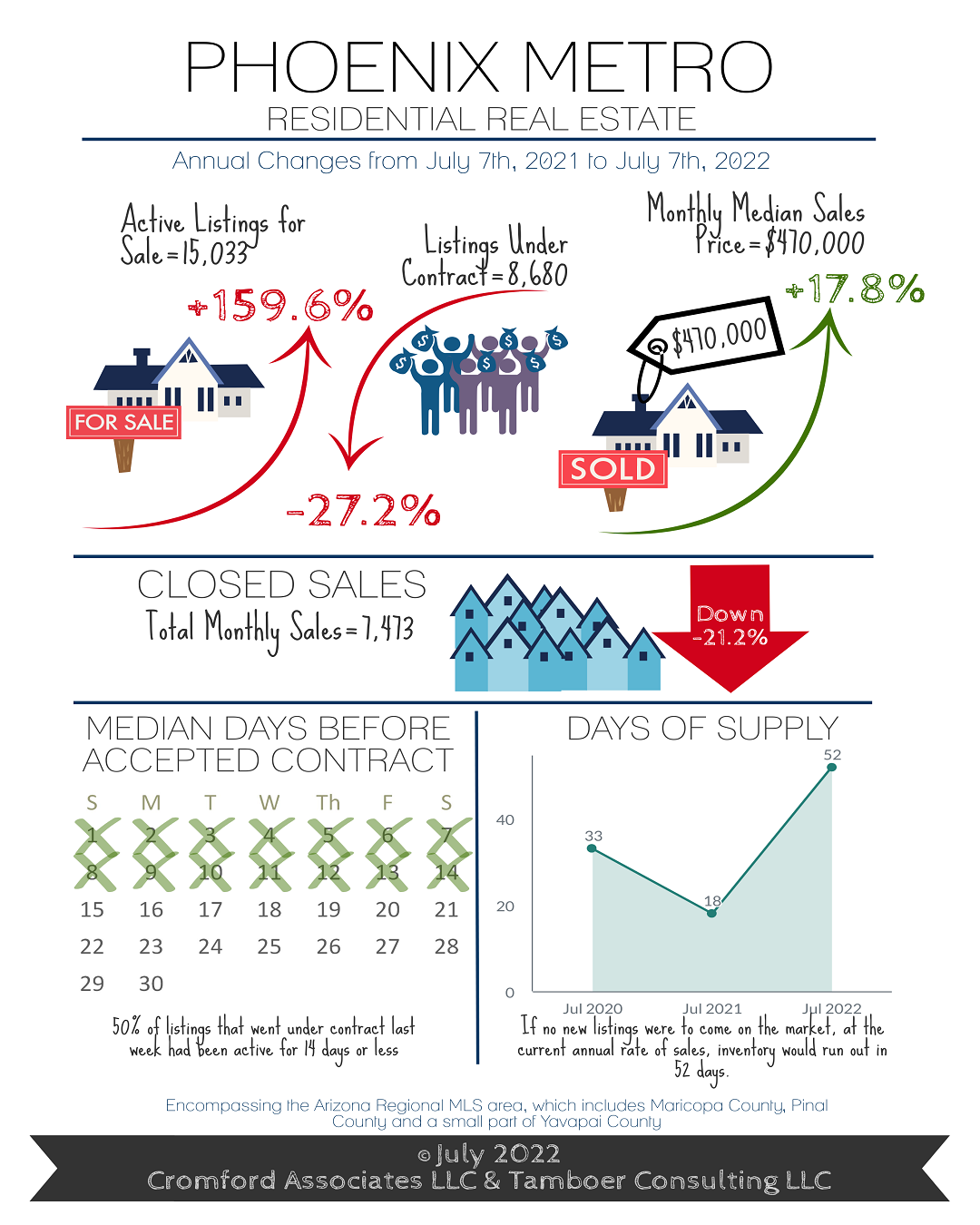

It’s no surprise that the market has been shifting since February, with the primary influence being large mortgage rate increases. However, over the past 6 weeks mortgage rates have been particularly volatile, fluctuating from 5.1% to 5.8% within 3 weeks only to drop to 5.3% over the next 2 weeks, and then back up to 5.8% a week later. History tells us that buyers do not like sharp, rapid fluctuations in mortgage rates. It causes buying activity to freeze until a level of stability and certainty can be achieved. This market is no different, contract activity has dropped 28% in the last 6 weeks. The number of listings under contract at this time of year should be around 10,000, putting today’s count of 8,680 well below normal.

In the meantime, a 220% increase in supply over the past 15 weeks has put pressure on sellers to compete. With cash buyers offering significantly below list price recently, attention is back on traditional buyers, many of whom have been priced out of the market due to affordability. Price reductions have gone up 500% since March, but have done little to increase demand as mortgage rate increases offset their effect and continue to keep payments high.

But not all is lost! Cue the interest rate buydown, a seller concession tool that has been collecting dust, unneeded, for well over a decade. The reason price reductions have had little effect on affordability is a $10,000 price reduction only saves a buyer $53 on their mortgage payment at 5.8%. However, for a similar cost a seller can buy down a buyer’s mortgage rate and save them $100’s on their monthly mortgage payment, either permanently or temporarily depending on the plan; thus putting their property at a higher competitive advantage than just a straight up price reduction.

Price reduction vs. rate buydown options: |